As a startup CEO, one of your biggest challenges is often the lack of funds. Running a business comes with ongoing expenses, and not everyone is eligible for traditional funding or loans. However, crowdfunding presents a viable solution. Are you curious to learn more about crowdfunding?

In today’s article, we introduce another funding possibility for startups: crowdfunding!

Crowdfunding – what is that?

Crowdfunding is an innovative solution for startups, particularly popular in the United States. It involves entrepreneurs, startups, or companies seeking assistance, support, and funding from Internet users. In return, backers may receive ready-to-use products or shopping discounts. Often, these products or services are limited and cater to a specific target audience. This type of funding can be applied to various ventures, as long as it complies with the law. Common crowdfunding categories include games, electronics, travel accessories, and unique services.

Various Funding Options

Crowdfunding offers diverse funding options, each typically governed by different regulations. If you’re considering this service for your startup, explore these various options:

- Foundation Crowdfunding: In this model, supporters make deposits without any specific agreements.

- Reward-Based One: Supporters receive specific benefits, which may not necessarily equate to the financial support provided.

- Crowdfunding Based on Pre-Sales: Backers contribute money for a specific product, and then after production, they’ll get the limited items.

- Shareholder Crowdfunding: Individuals interested in assisting your startup can purchase shares or stocks in your company.

- Debt Crowdfunding: People provide financial assistance to startups, with the expectation of repayment after certain milestones or processes.

Legal Considerations

While crowdfunding offers flexibility, it doesn’t exempt you from adhering to legal requirements. Even though there isn’t specific regulation, you must follow the rules associated with the type of contract you establish with your supporters.

Legal Relationships

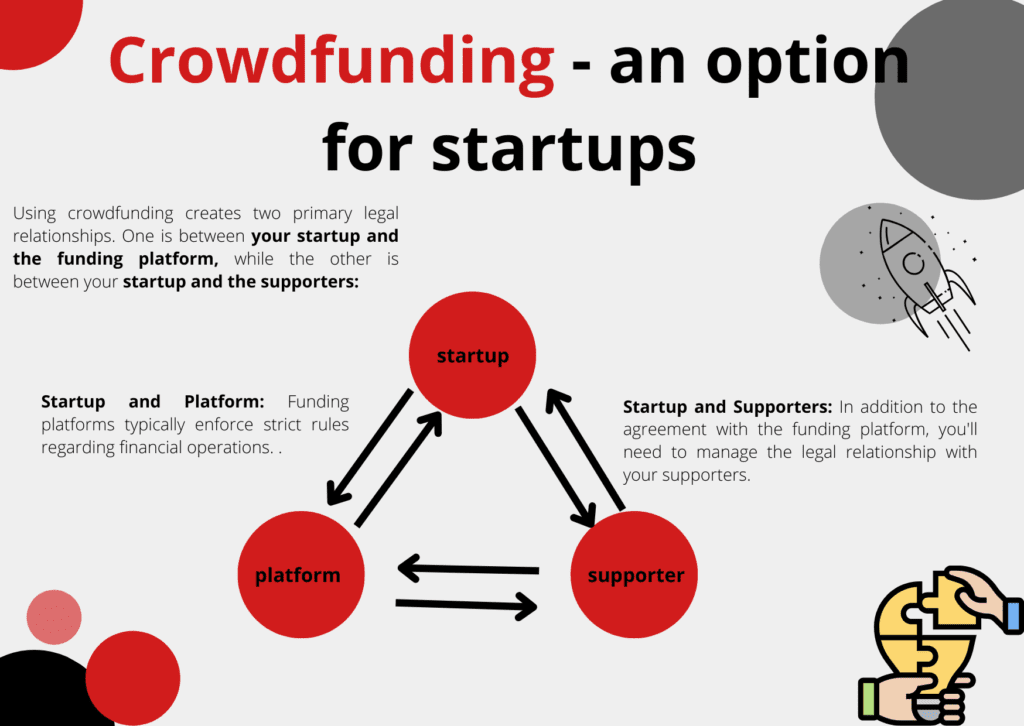

Using crowdfunding creates two primary legal relationships. One is between your startup and the funding platform, while the other is between your startup and the supporters:

- Startup and Platform:Funding platforms typically enforce strict rules regarding financial operations. It’s crucial to thoroughly review the agreement, paying particular attention to the startup’s liability provisions. Platforms often try to impose resolutions that give them full responsibility for content posted on their platforms.

- Startup and Supporters: In addition to the agreement with the funding platform, you’ll need to manage the legal relationship with your supporters. This can be achieved through sales, loans, or other agreements. Remember that this may also entail a consumer contract, implying specific obligations and restrictions for your startup concerning its supporters.

Project Implementation

If your crowdfunding campaign succeeds, be prepared for legal demands from your supporters. They may request the fulfillment of their rights as defined in the contract, such as product delivery or the creation of the product for which they provided support.

Special Considerations for International Investment

If you’re interested in utilizing crowdfunding services from a foreign country, be doubly cautious about legal assessments. Seek advice from legal and tax advisors well-versed in the jurisdiction you’re dealing with. Keep in mind that offers on foreign platforms are likely governed by foreign laws, and any disputes will be resolved in foreign courts.

If you have any questions or need guidance on outsourcing, please don’t hesitate to reach out. Additionally, consider tuning in to our podcast, “Startup Stories,” where we delve into the intricacies of startups and what makes them thrive.